springfield mo sales tax rate 2020

What is the sales tax rate in Springfield Missouri. Find Sales and Use Tax Rates.

Expert Advice For Moving To Springfield Mo 2022 Relocation Guide

012020 - 032020 - PDF.

. Statewide salesuse tax rates for the period beginning February 2020. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The minimum combined 2022 sales tax rate for Springfield Missouri is.

Interactive Tax Map Unlimited Use. Higher sales tax than 61 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175. Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual 13301 Year-to-date sales tax revenues are up 01 compared to budget through May 2020 The City of Springelds May.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax. East Main Street Springfield OH 45503 Phone. The new tax will start on april 1st.

Counties and cities can charge an additional local sales tax of up to 5125 for a. The current total local sales tax rate in Springfield MO is 8100. Statewide salesuse tax rates for the period beginning January 2020.

Missouri Sales Tax Rates By City County 2022. The December 2020 total local sales tax. Section 144014 RSMo provides a reduced tax rate for certain food sales.

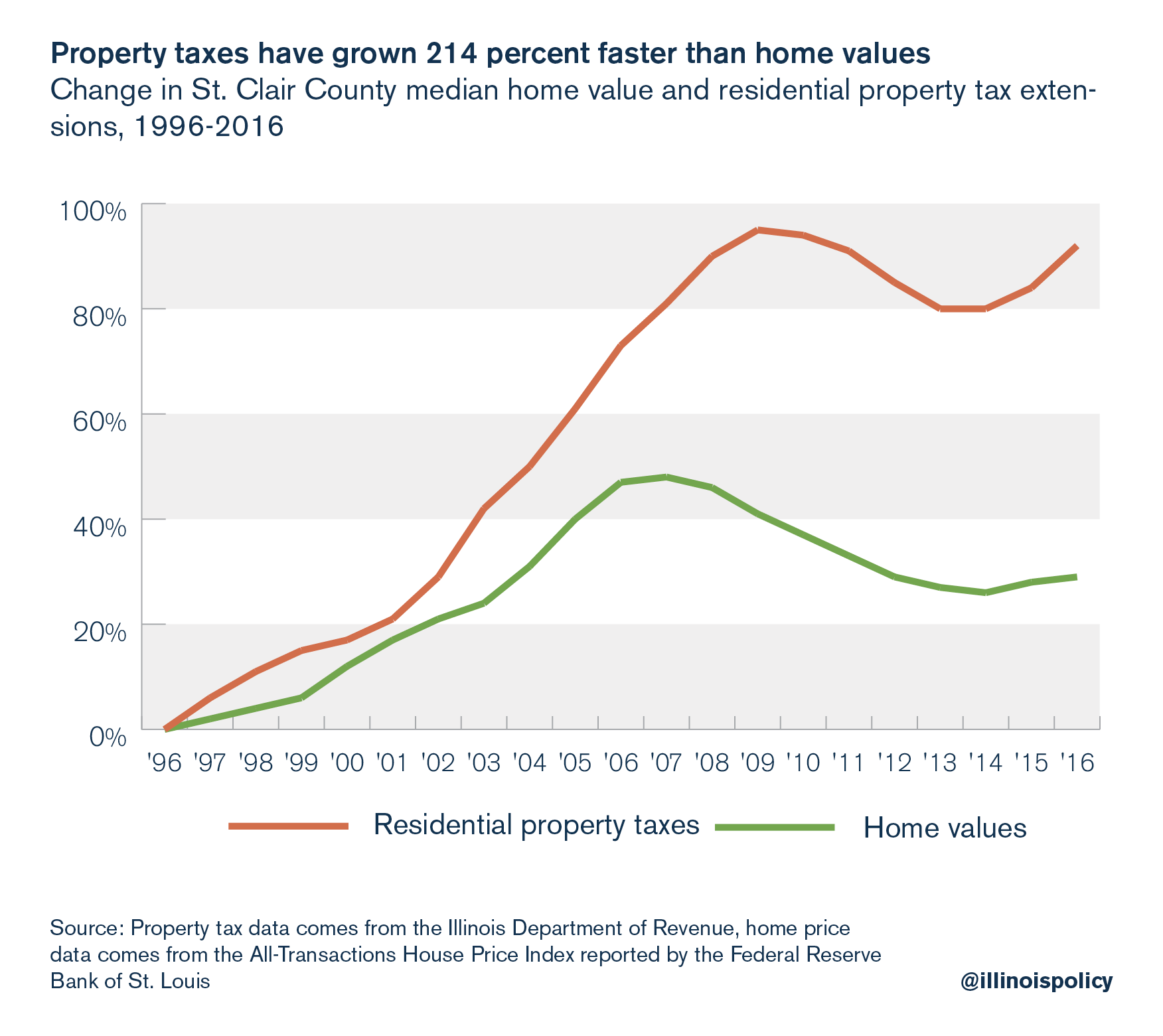

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. This is the total of state county and city. Missouri Department of Revenue 2020 View sales tax rates in other Missouri cities Springfield Property.

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Missouri MO Sales Tax Rates by City The state sales tax rate in Missouri is 4225. Section 144014 RSMo provides a reduced tax rate for certain food sales.

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. This is the total of state county and city sales tax rates. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales.

Raised from 6225 to 8725. Indicates required field. Enter your street address and city or zip code to view the sales and use tax rate information for your address.

The December 2020 total local sales tax rate was also 8100. With local taxes the total sales tax rate is between 4225 and 10350. Meares Property Advisors has contracted with Lexington County to handle the 2020 Delinquent Tax Auction.

The rate for food sales was reduced by 3 from 4225 to 1225. The December 2020 total local sales tax rate was also 8100. Springfield Sales Tax Total 8100 State 4225 County 1750 City 2125 Source.

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Illinoisans Will Pay Higher Online Sales Tax Starting In 2020

Missouri Vehicle Registration Of New Used Vehicles Faq

Solarize Kc Will Make It More Affordable To Install Solar In Kc Homes News Releases Kcmo Gov City Of Kansas City Mo

1460 E Grand St Springfield Mo 65804 Realtor Com

Michigan Sales Tax Guide For Businesses

What Do Springfield Residents Pay In Sales Tax

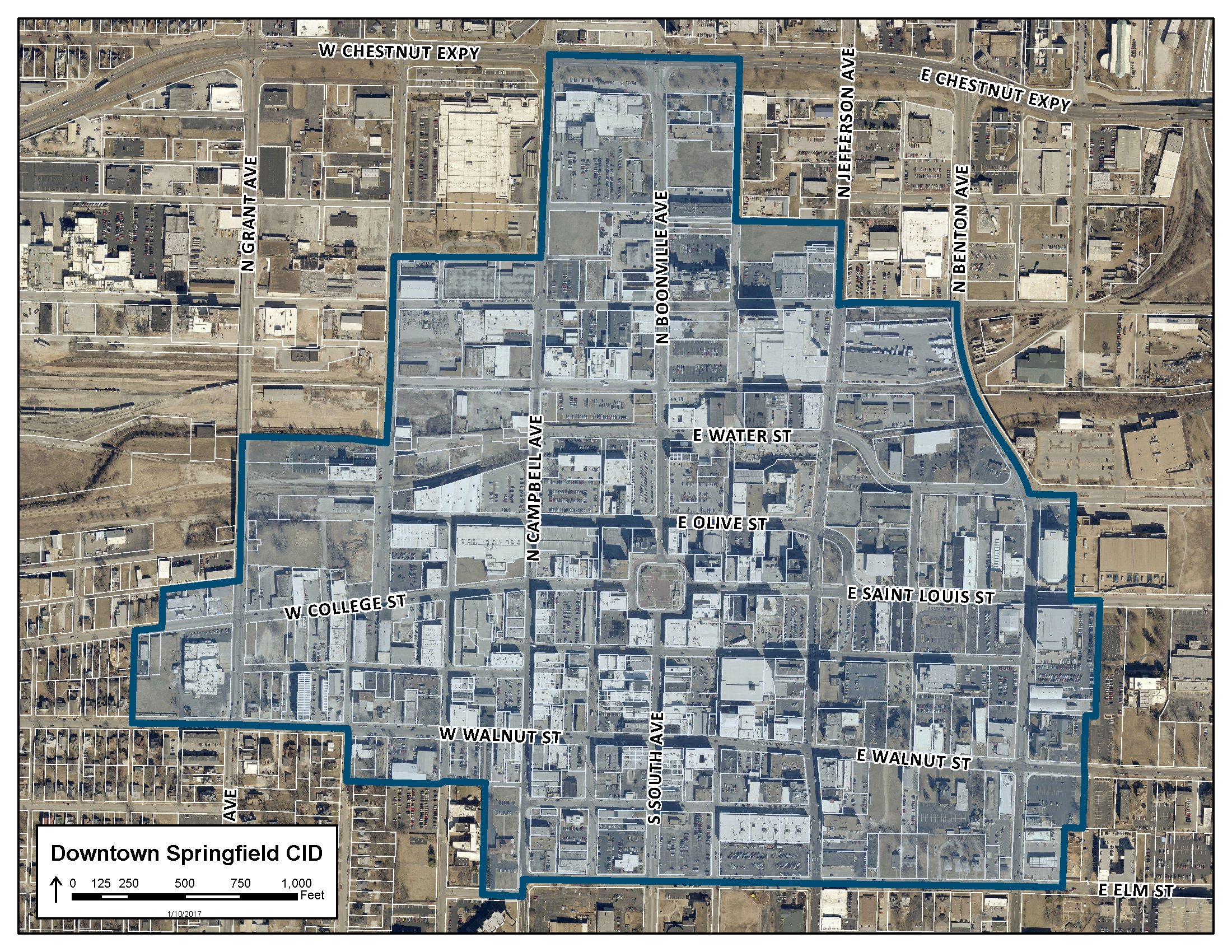

Downtown Springfield Community Improvement District

Missouri Governor Calls Special Session After Labor Day On 700 Million Income Tax Cut Missouri Independent

Used Gmc Yukon Xl For Sale In Springfield Mo Edmunds

Total Gross Domestic Product For Springfield Mo Msa Ngmp44180 Fred St Louis Fed

Illinois Income Tax Calculator Smartasset

State Sales Tax Rates Sales Tax Institute

Taxes Springfield Regional Economic Partnership

1721 S National Ave Springfield Mo 65804 Realtor Com